When it comes to financial planning, life insurance is often relegated to a secondary status—a safety net to protect loved ones in the event of the unexpected. However, beyond the fundamental promise of financial security, life insurance policies can also serve as a valuable tool in your tax strategy. By understanding how these policies work, you can unlock a variety of tax benefits that may enhance your overall financial health. In this article, we’ll delve into the intricacies of life insurance, exploring how different types can impact your tax liability, and providing clarity on how to make informed decisions that align with your financial goals. Whether you are considering a policy for the first time or looking to optimize an existing one, grasping the tax implications can empower you to make the most of your life insurance investment.

Table of Contents

- Understanding the Tax Advantages of Life Insurance Investments

- How Different Types of Life Insurance Impact Your Tax Situation

- Maximizing Tax Benefits Through Strategic Policy Ownership

- Common Myths About Life Insurance and Taxes Debunked

- Key Takeaways

Understanding the Tax Advantages of Life Insurance Investments

Investing in life insurance can offer significant tax advantages that often go unnoticed. One of the primary benefits is that the death benefit paid out to beneficiaries is typically income tax-free. This means that the financial support provided to your loved ones in the event of your passing will not be taxed, allowing them to receive the full value of the policy. Additionally, the cash value that accumulates in permanent life insurance policies grows on a tax-deferred basis. This allows policyholders to accumulate savings within the policy without worrying about immediate tax implications.

Furthermore, policyholders can access the cash value through loans or withdrawals. When structured correctly, these transactions can also be tax-free. Here are some additional points to consider regarding tax benefits associated with life insurance investments:

- Premium Payments: Depending on the policy structure, contributions to certain types of policies may be made using pre-tax dollars.

- Estate Planning: The death benefit can be structured to avoid estate taxes in certain cases, preserving assets for heirs.

- Charitable Contributions: Policies can be used to fund charities, offering a tax deduction for the premiums paid.

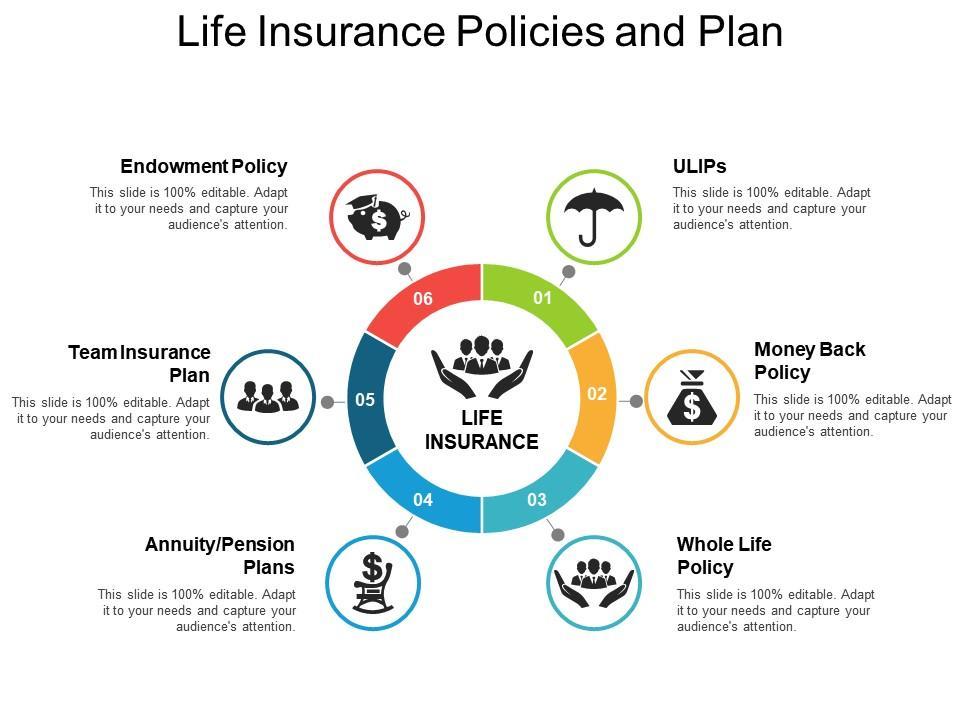

How Different Types of Life Insurance Impact Your Tax Situation

Life insurance policies can have diverse implications for your tax situation, depending on the type of coverage you choose. In general, the death benefit received by beneficiaries is typically tax-free, allowing loved ones to receive the financial support intended without the burden of taxation. However, it’s essential to consider the different types of policies that may affect your tax liability over time:

- Term Life Insurance: Generally, this policy has no cash value, and the premiums paid are not tax-deductible. However, the death benefit remains tax-exempt.

- Whole Life Insurance: This type of policy includes a cash value component that grows over time. While the death benefit is tax-free, withdrawals or loans against the cash value may incur tax implications.

- Universal Life Insurance: Similar to whole life, it accumulates cash value, but the flexible premium payments and death benefit options can lead to varying tax consequences depending on how the policy is managed.

It’s equally important to understand how life insurance can be integrated into estate planning. Here’s a quick overview of tax considerations:

| Policy Type | Death Benefit Tax Status | Cash Value Growth Tax Status |

|---|---|---|

| Term Life | Tax-free | N/A |

| Whole Life | Tax-free | Tax-deferred until withdrawal |

| Universal Life | Tax-free | Tax-deferred until withdrawal |

Maximizing Tax Benefits Through Strategic Policy Ownership

Understanding how to strategically leverage life insurance policies can significantly enhance your tax benefits. Permanent life insurance policies, such as whole life and universal life, provide key tax advantages that can be advantageous in financial planning. For one, the cash value that accumulates within these policies grows tax-deferred, meaning you won’t owe any taxes on the earnings until you withdraw funds or surrender the policy. Moreover, policy loans taken against the cash value are typically not taxable, presenting a unique opportunity to access funds without immediate tax repercussions.

Additionally, the death benefit paid to beneficiaries is often income tax-free, providing not only peace of mind but also a powerful estate planning tool. To maximize these benefits, consider the following strategies:

- Regularly review your policy to ensure it aligns with your long-term financial goals.

- Make premium payments strategically, as they can affect your cash value and death benefit.

- Explore the use of riders that may further enhance both protection and tax advantages.

By integrating these elements into your financial strategy, you can effectively use life insurance not just as a safety net, but as a pivotal component in maximizing your tax efficiency.

Common Myths About Life Insurance and Taxes Debunked

There are several misconceptions about how life insurance interacts with taxes that can lead to confusion and misinformation. One common myth is that the death benefit from a life insurance policy is taxable. In reality, the death benefit paid out to beneficiaries is generally not subject to income tax. This means that your loved ones can receive the full amount, helping to ease their financial burden without additional tax liabilities. Additionally, some believe that the cash value accumulations in permanent life insurance policies are capital gains and therefore taxable. However, these accumulations grow on a tax-deferred basis, which means you won’t owe taxes on the growth until you withdraw funds or surrender the policy.

Another frequent misunderstanding centers around the impact of life insurance on your estate taxes. Many people worry that the death benefit will push their estate over the taxable threshold. While it’s true that life insurance proceeds can be included in the taxable estate, there are strategies to mitigate this, such as naming a beneficiary or establishing an irrevocable life insurance trust (ILIT). By doing so, the death benefits can be kept out of your estate, offering potentially significant tax savings. Furthermore, some believe that premiums paid for life insurance are not tax-deductible, which is generally true; however, if the policy is part of a business structuring, such as group life insurance, premiums might be deductible, adding another layer of complexity to the tax implications.

Key Takeaways

understanding the tax benefits associated with life insurance policies can greatly enhance your financial strategy and provide peace of mind for you and your loved ones. By knowing how these policies work, you can make informed decisions that align with your long-term financial goals. Whether you’re considering a policy for the first time or reevaluating your existing coverage, it’s essential to consult with a financial advisor or tax professional to ensure you’re maximizing the advantages available to you. As you navigate the complexities of life insurance and tax implications, remember that the right policy can not only safeguard your family’s future but also serve as a valuable tool in building your overall financial health. Thank you for joining us on this journey to unlock the potential of life insurance—your financial future awaits!