As pet owners, we often find ourselves celebrating the joy and companionship our furry friends bring into our lives. However, along with those happy moments come responsibilities—chief among them, ensuring our pets receive the best possible care, especially when health issues arise. This is where pet insurance comes into play. With a variety of plans available on the market, navigating the world of pet insurance can feel overwhelming. In this guide, we’ll break down the essential components of pet insurance, exploring its benefits, types of coverage, and what to consider when choosing a policy. Whether you’re a new pet parent or a seasoned owner, understanding pet insurance can empower you to make informed decisions about your beloved companion’s health and well-being.

Table of Contents

- Choosing the Right Pet Insurance Plan for Your Needs

- The Benefits and Limitations of Pet Insurance Coverage

- Common Exclusions and What to Watch Out For

- Tips for Submitting Claims and Getting Reimbursed

- Concluding Remarks

Choosing the Right Pet Insurance Plan for Your Needs

When it comes to selecting a pet insurance plan, it’s essential to assess your unique circumstances and preferences. Every pet is different, and so are the medical needs that arise over their lifetime. Begin by considering the following factors:

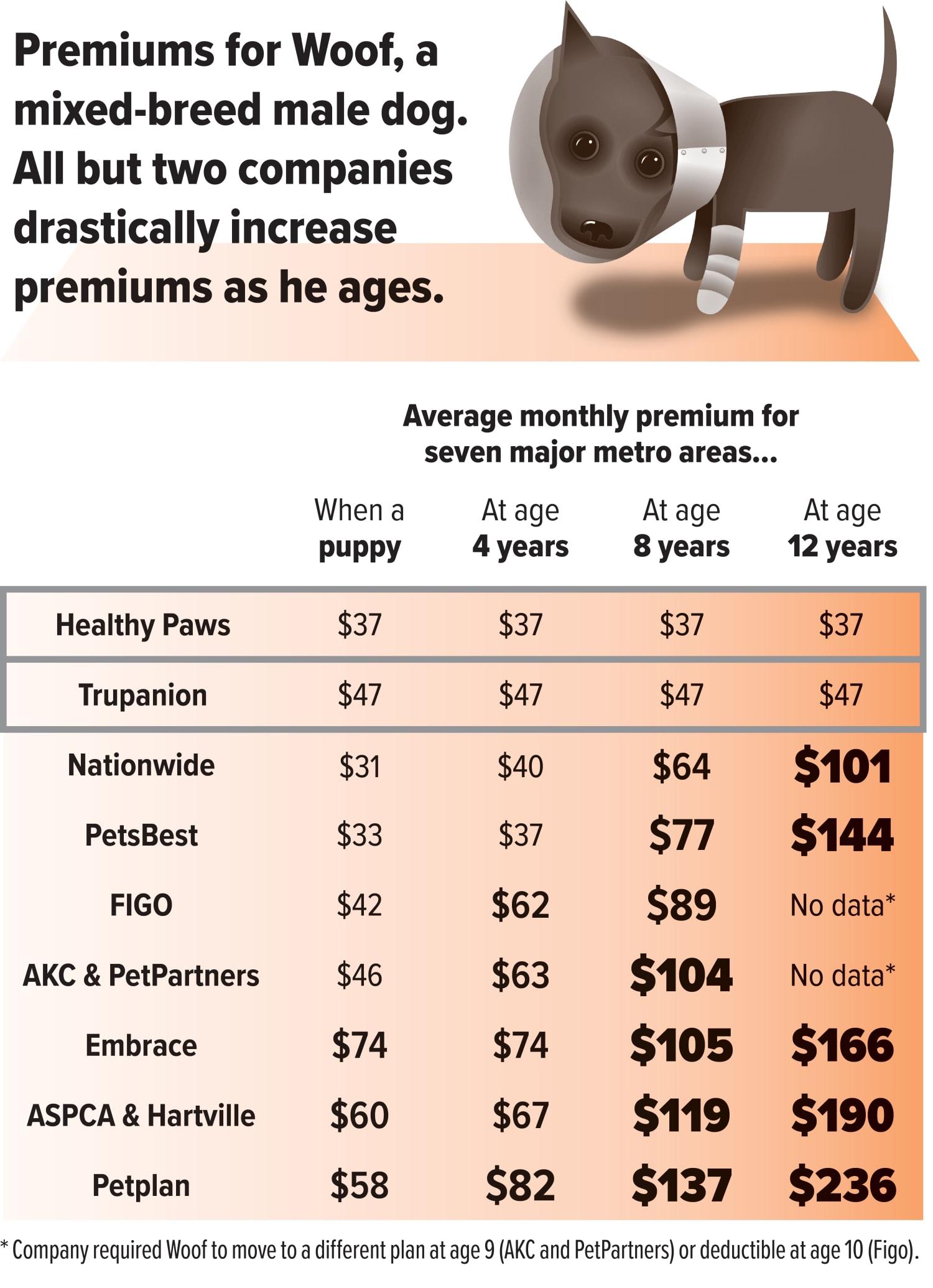

- Your Pet’s Age and Breed: Older pets or certain breeds may have predispositions to specific health conditions, which could influence the type of coverage you need.

- Your Budget: Determine a comfortable monthly premium range while also considering deductibles, co-pays, and potential annual limits.

- Coverage Options: Evaluate plans that include accidents, illnesses, preventive care, and more specialized care like dental or prescription medications.

Comparing different plans can be overwhelming, so organizing your findings can help streamline the decision-making process. Consider making a simple comparison table:

| Insurance Provider | Monthly Premium | Annual Limit | Deductible | Coverage Type |

|---|---|---|---|---|

| Provider A | $30 | $10,000 | $250 | Accident & Illness |

| Provider B | $45 | No Limit | $500 | Comprehensive Care |

| Provider C | $25 | $5,000 | $200 | Accident Only |

Also, check online reviews and ask fellow pet owners about their experiences with different insurers. By taking a comprehensive approach, you’ll be better equipped to choose a plan that suits both your financial situation and your beloved pet’s needs.

The Benefits and Limitations of Pet Insurance Coverage

Pet insurance can be a game-changer for pet owners, providing peace of mind and financial relief when unexpected health issues arise. Some key advantages of having pet insurance include:

- Financial Protection: Coverage helps mitigate the high costs of veterinary care, ensuring that treatments are accessible without compromising on quality.

- Comprehensive Care: Policies often cover a wide range of services, from preventive care to serious medical procedures, allowing pets to receive the attention they need.

- Freedom of Choice: Many plans allow you to choose any veterinarian, which means you don’t have to settle for a provider based on insurance limitations.

However, pet insurance also has its limitations that potential policyholders should consider. Some common drawbacks include:

- Premium Costs: Monthly fees can add up, and it’s essential to evaluate whether the coverage justifies the expense based on your pet’s health and age.

- Exclusions and Waiting Periods: Many policies have specific exclusions for pre-existing conditions and may impose waiting periods before coverage kicks in.

- Complex Claim Processes: Navigating the claims process can be tedious, which may deter some from seeking necessary care for their pets.

Common Exclusions and What to Watch Out For

When investing in pet insurance, it’s essential to be aware of the common exclusions that may apply to your policy. Many plans do not cover pre-existing conditions, which are any health issues that your pet had before the insurance coverage began. Additionally, routine care, such as vaccinations, flea and tick prevention, and dental cleanings, is often excluded. These services may be crucial for your pet’s overall health, but unless specified in an add-on or separate wellness plan, you may need to pay for them out of pocket. Understand these exclusions to make an informed decision and budget accordingly.

Another important factor to consider is the waiting periods imposed by insurance providers. After purchasing your policy, there is typically a set duration in which coverage will not apply, especially for certain conditions. These waiting periods can vary significantly between policies, so it’s important to read the fine print. Additionally, be cautious of breed-specific exclusions—some companies may have restrictions on certain breeds that are prone to specific health issues. Always review your policy thoroughly to fully grasp what is covered and what isn’t.

Tips for Submitting Claims and Getting Reimbursed

When it comes to submitting claims for your pet insurance, organization is key. Before initiating your claim, ensure you have all necessary documentation at hand. This may include:

- Vet invoices: Clearly itemized bills showing services provided.

- Medical records: Relevant documents that explain your pet’s condition and treatment.

- Claim forms: Completed forms from your insurance provider with accurate information.

In addition to gathering your documents, double-check everything for accuracy to avoid delays. After submission, keep track of your claim’s status and don’t hesitate to follow up with your insurer. Many pet owners find it helpful to maintain a timeline that tracks key dates and all correspondence, which can include:

| Date | Action Taken | Status/Notes |

|---|---|---|

| MM/DD/YYYY | Claim submitted | Awaiting response |

| MM/DD/YYYY | Follow-up email sent | Claim under review |

| MM/DD/YYYY | Claim approved | Payment processed |

Concluding Remarks

navigating the world of pet insurance can seem daunting, but being informed is the first step toward making the best choice for your furry family members. By understanding the various types of coverage, the importance of reading policy details, and evaluating your pet’s specific needs, you can select a plan that not only fits your budget but also provides peace of mind. Remember, each pet is unique, and so are their healthcare needs. Take the time to research different providers, compare policies, and don’t hesitate to ask questions. Your pet deserves the best care possible, and with the right pet insurance, you can ensure they receive it without the added worry of unexpected expenses. Happy pet parenting!