As we age, planning for the future becomes increasingly important, especially when it comes to our healthcare needs. Long-term care insurance is a critical component of that planning, providing financial support for services like nursing care, assisted living, and other forms of assistance that may be required as we move into our later years. However, navigating the myriad of options available can be overwhelming, particularly with the complex terms and conditions that often come into play. In this article, we’ll break down what long-term care insurance is, explore the different types of policies available, and offer guidance on how to choose the right option to suit your needs. Whether you’re looking to ensure peace of mind for yourself or a loved one, understanding your choices is the first step toward making an informed decision about the future.

Table of Contents

- Understanding the Basics of Long-Term Care Insurance for Seniors

- Exploring Different Types of Long-Term Care Insurance Plans

- Assessing Coverage Needs and Financial Considerations

- Making Informed Choices: Tips for Selecting the Right Policy

- Key Takeaways

Understanding the Basics of Long-Term Care Insurance for Seniors

Long-term care insurance is a vital financial tool for seniors, providing coverage for services not typically included in standard health insurance or Medicare. As individuals age, the likelihood of needing assistance with daily living activities—such as bathing, eating, and dressing—can increase significantly. This specialized insurance helps cover costs associated with in-home care, assisted living facilities, or nursing homes, ensuring that seniors receive the necessary support without depleting their savings. Some key features of long-term care insurance include:

- Customized Plans: Policies can be tailored to meet specific needs, offering different levels of coverage and benefits.

- Eligibility Criteria: Generally includes a waiting period before benefits begin, usually requiring a certification of the need for care.

- Daily Benefit Amount: The maximum amount the policy will pay per day for covered services.

Before purchasing a policy, it’s essential for seniors and their families to carefully evaluate their options and consider factors such as the cost of care in their area and personal health history. Long-term care insurance can vary greatly in terms of pricing and coverage, so it’s beneficial to compare multiple quotes and consult with financial advisors. The following summarizes key components to consider when seeking a long-term care insurance policy:

| Component | Description |

|---|---|

| Premiums | Monthly or annual payments required to maintain the policy. |

| Benefit Period | The length of time benefits are paid, which can range from a few years to a lifetime. |

| Inflation Protection | Options to increase benefits over time to keep pace with inflation. |

Exploring Different Types of Long-Term Care Insurance Plans

When considering long-term care insurance plans, it’s essential to understand the various options available to cater to different needs and preferences. One popular choice is Traditional Long-Term Care Insurance, which provides coverage for a wide range of services, from at-home care to nursing home facilities. This plan typically requires the policyholder to pay premiums until they are ready to use the benefits, at which point the insurer covers the cost of care, subject to the policy’s stipulations. Another attractive option is Hybrid Plans, which combine life insurance with long-term care benefits. These plans ensure that if you never need long-term care, your beneficiaries will receive a death benefit, making it an appealing investment for many seniors.

Additionally, Short-Term Care Insurance is designed for individuals who may require care for a limited time, often after a hospital stay. This plan can help bridge the gap for those who have exhausted their regular health insurance benefits. For those seeking flexibility, Cash Benefit Plans allow policyholders to receive a cash payout for their care needs, giving them the freedom to select their care providers. A comparison of key features can offer further clarification:

| Type of Care Plan | Key Features |

|---|---|

| Traditional Long-Term Care | Comprehensive coverage for various services |

| Hybrid Plans | Combines life insurance with LTC benefits |

| Short-Term Care | Focus on temporary care needs post-hospitalization |

| Cash Benefit Plans | Cash payouts for flexibility in care choices |

Assessing Coverage Needs and Financial Considerations

Determining the right level of long-term care insurance coverage involves a thorough assessment of individual needs, preferences, and financial circumstances. Factors to consider include:

- Current Health Status: Evaluate any existing medical conditions that may require care.

- Family Support: Consider the availability of family members who can provide care.

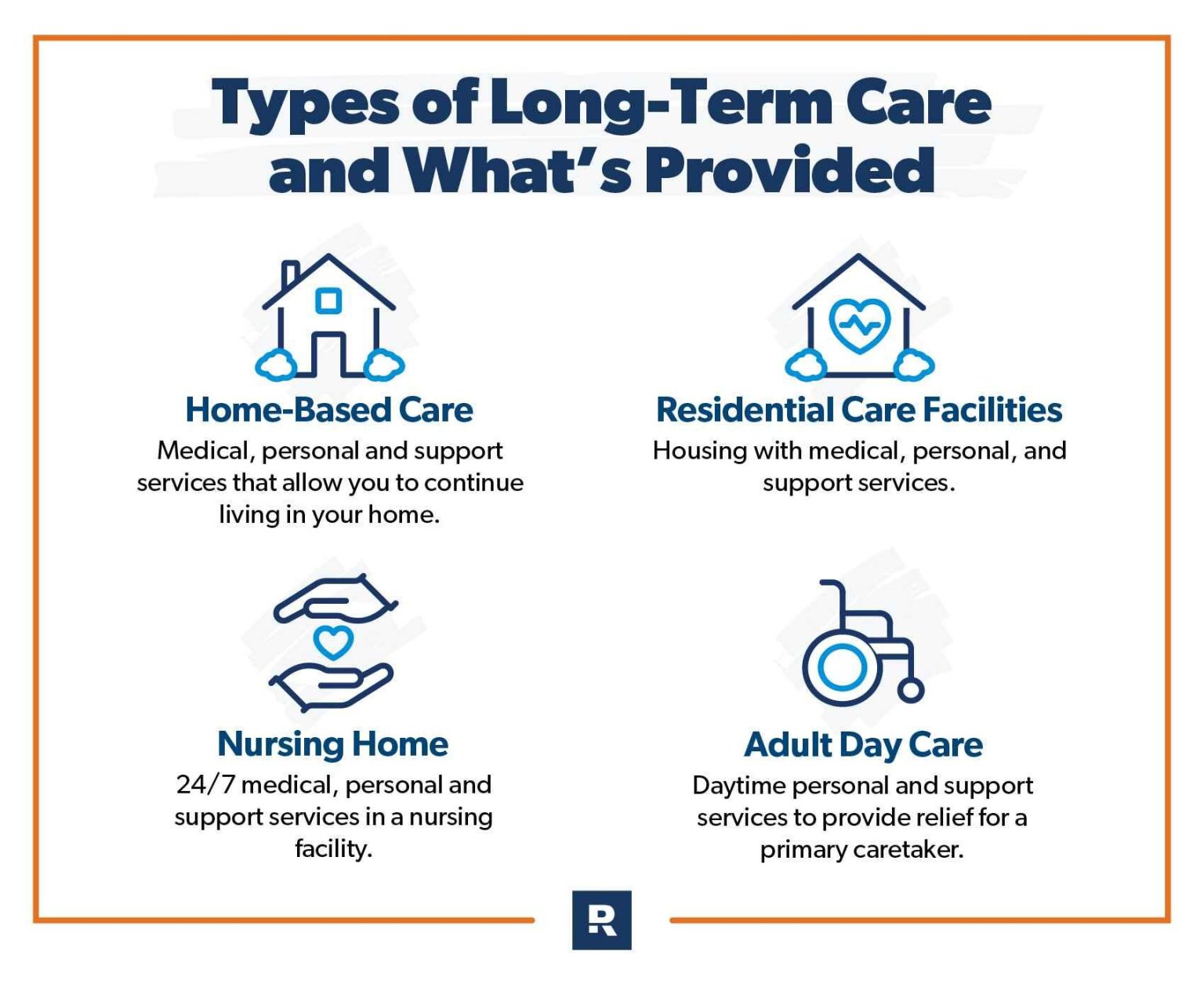

- Type of Care Needed: Identify whether care will be needed at home, in assisted living, or in a nursing facility.

- Duration of Care: Assess potential length of care based on life expectancy and health projections.

Financial considerations play a key role in choosing the right policy. It’s important to balance coverage with affordability. To help navigate these financial aspects, potential policyholders should examine:

| Cost Factors | Description |

|---|---|

| Premiums | Monthly or annual costs associated with maintaining the insurance policy. |

| Deductibles | The amount paid out of pocket before the insurance coverage kicks in. |

| Benefit Amount | The maximum payout the policy will provide for long-term care services. |

| Inflation Protection | Adjustment options to ensure benefits keep pace with rising costs of care. |

Making Informed Choices: Tips for Selecting the Right Policy

Choosing the right long-term care insurance policy requires careful consideration and research. Start by assessing your individual needs and financial situation. Ask yourself the following questions:

- What type of care do I envision needing in the future?

- How much can I afford to pay in premiums?

- What is the maximum benefit period I might require?

Understanding these factors will help you narrow down your options. It’s also worthwhile to check if your current health insurance covers any home health care services, as this may impact your long-term care insurance needs.

As you delve into different policies, look for a company with a solid reputation and financial stability. Consider these important elements:

- Daily Benefit Amount: Determine how much assistance you’ll need each day for care services.

- Elimination Period: This is the waiting period before benefits kick in; a longer period may reduce your premium.

- Inflation Protection: Choose a policy that adjusts for inflation to maintain your coverage value over time.

Moreover, don’t hesitate to consult with a financial advisor or insurance specialist who can provide personalized insights and enhance your understanding of available options. They can guide you through the complexities and help you find a plan that aligns with your financial goals.

Key Takeaways

As we navigate the various options for long-term care insurance, it’s essential to prioritize understanding your unique needs and preferences. By exploring the different types of policies available, assessing your financial situation, and considering the level of care you may require in the future, you can make informed decisions that best suit your circumstances. Remember, the goal of long-term care insurance is not just to provide financial support, but also to enhance your quality of life and peace of mind in your later years.

Ultimately, the right long-term care insurance plan can offer you and your loved ones reassurance that you will be taken care of when the time comes. Whether you’re just beginning your search or are already sifting through options, take your time to research and consult with professionals who can guide you through the process. Keeping a proactive approach will empower you to secure a future that aligns with your desires and needs. Thank you for joining us in this exploration of long-term care insurance options for seniors. We hope you found this information helpful as you plan for a more secure future.