In the world of car ownership, navigating the complexities of insurance can often feel overwhelming. One term that frequently pops up, especially when discussing vehicle financing or leasing, is “gap insurance.” But what exactly is gap insurance, and do you really need it? This article aims to demystify gap insurance, breaking it down into simple terms so that you can make an informed decision about your coverage. Whether you’re a first-time buyer or looking to refresh your knowledge, this guide will provide clarity on what gap insurance is, how it works, and why it might be a beneficial addition to your vehicle protection plan. Let’s dive in and explore the ins and outs of gap insurance.

Table of Contents

- Understanding the Basics of Gap Insurance and Its Importance

- How Gap Insurance Works: Key Features You Need to Know

- Factors That Influence Gap Insurance Rates and Coverage

- Tips for Choosing the Right Gap Insurance for Your Vehicle

- Key Takeaways

Understanding the Basics of Gap Insurance and Its Importance

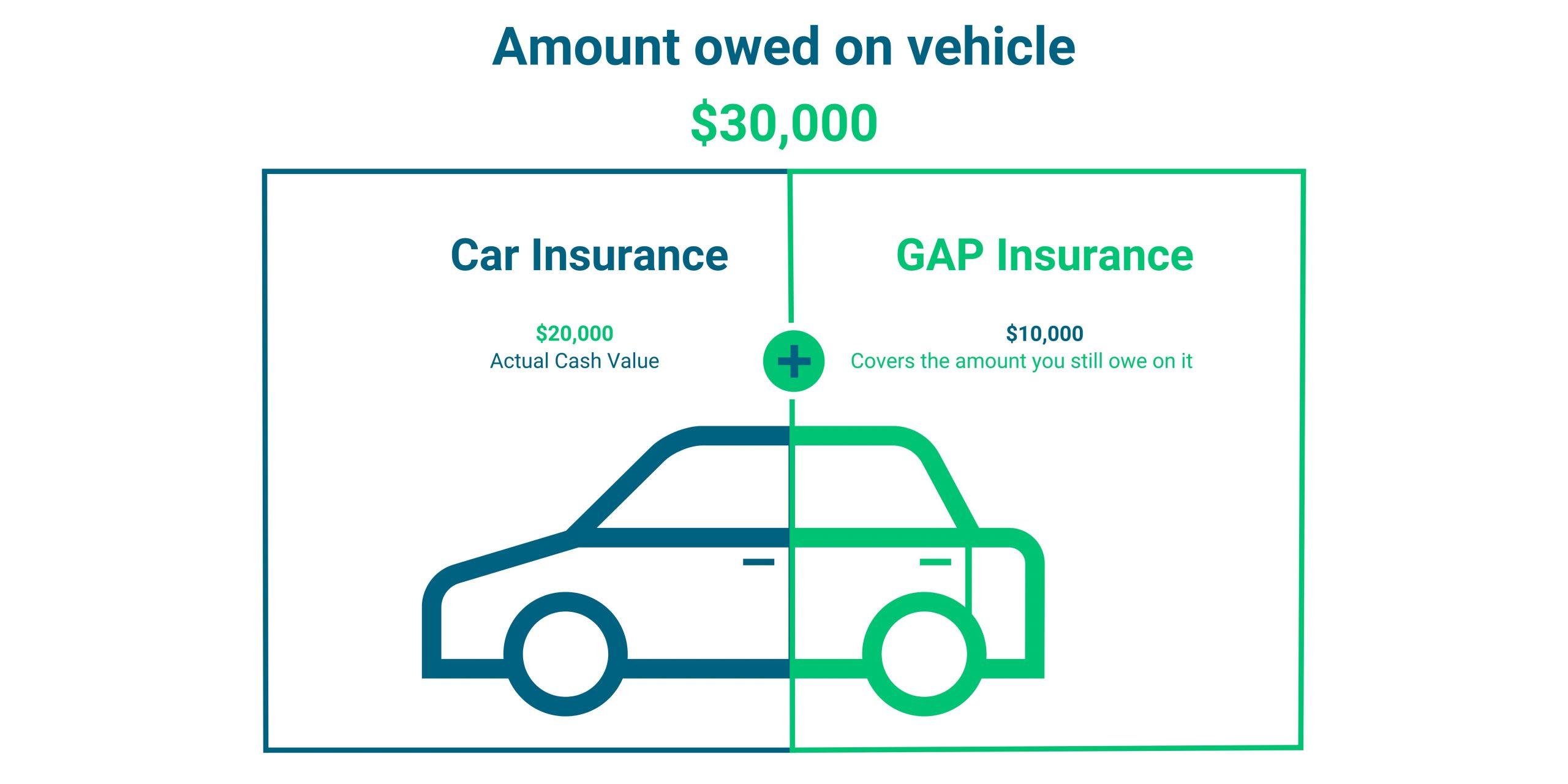

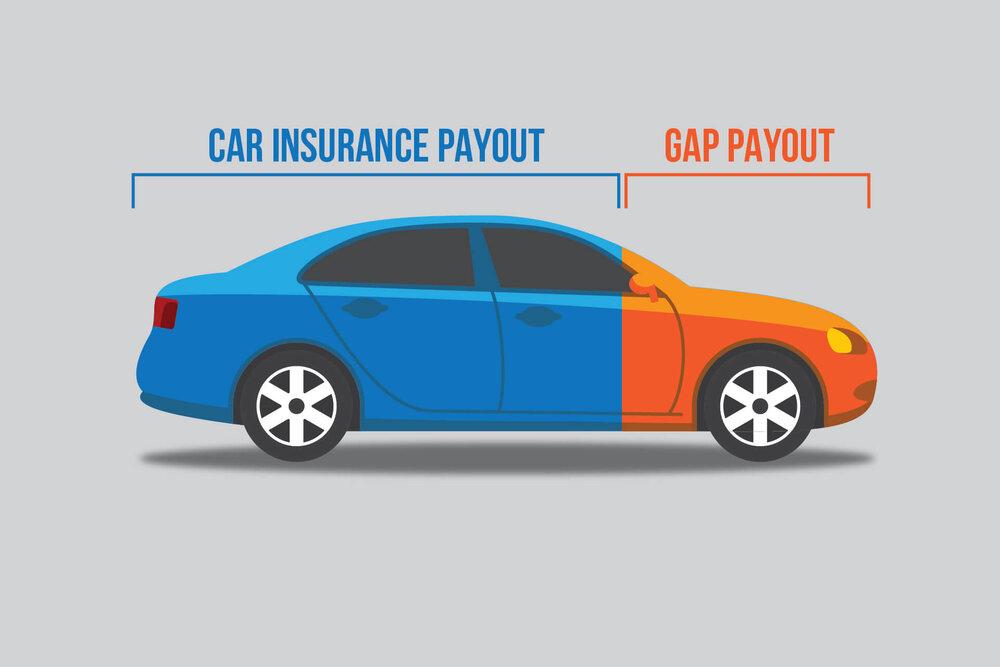

Gap insurance is an essential coverage option that provides financial protection in the event your vehicle is totaled or stolen. Traditional auto insurance typically covers only the current market value of your car at the time of loss, which may be significantly less than what you owe on an auto loan or lease. This discrepancy can leave you with a substantial financial burden if the vehicle is a total loss. That’s where gap insurance comes in, covering the “gap” between the insurance payout and the remaining loan balance, ensuring you don’t have to pay out of pocket for a vehicle you can no longer drive.

Understanding the importance of gap insurance can help vehicle owners make informed decisions about their coverage. Here are some critical aspects to consider:

- Reduces Financial Risk: Protects against losses greater than the vehicle’s market value.

- Ideal for New or Financed Cars: Especially beneficial for those who have recently purchased a vehicle with a high loan balance.

- Peace of Mind: Offers reassurance knowing that you are covered, even in unfortunate situations.

| Scenario | With Gap Insurance | Without Gap Insurance |

|---|---|---|

| Vehicle is totaled | Loan balance covered | Pay out of pocket |

| Vehicle is stolen | Loan balance covered | Pay out of pocket |

| Owner’s peace of mind | Yes | No |

How Gap Insurance Works: Key Features You Need to Know

Gap insurance is designed to bridge the gap between the amount you owe on your vehicle and its actual cash value in the event of a total loss. This type of coverage becomes particularly important for new cars, which typically depreciate rapidly. In the unfortunate event of an accident, standard auto insurance will only compensate you for the car’s current market value, which may be significantly lower than what you still owe on your loan or lease. By having gap insurance, you ensure that you remain financially secure, covering the difference and preventing out-of-pocket costs.

Here are some key features of gap insurance that you should be aware of:

- Coverage Period: Gap insurance typically lasts until your loan balance is equal to the car’s value.

- Vehicle Types: It’s especially beneficial for leased and financed vehicles that depreciate quickly.

- Cost: Gap insurance is often quite affordable, making it a small price to pay for peace of mind.

- Availability: Many insurers offer gap coverage as an add-on to standard auto policies.

Understanding these features can help you make an informed decision about whether gap insurance is necessary for your situation. You can compare different plans and seek options that best suit your individual needs. Below is a simple comparison of how gap insurance differs from standard auto insurance:

| Aspect | Standard Auto Insurance | Gap Insurance |

|---|---|---|

| Payout Basis | Actual cash value of the vehicle | Difference between owed amount and cash value |

| Who It Benefits | Vehicle owners | Financed or leased vehicle owners |

| Cost | Varies, based on policy | Generally low premium |

Factors That Influence Gap Insurance Rates and Coverage

Several elements contribute to the determination of your gap insurance rates and the extent of coverage you can expect. Vehicle type plays a crucial role; luxury or high-end models may come with higher premiums. Additionally, the age of the vehicle affects its depreciation rate, which in turn impacts the gap insurance cost. Other critical factors include your driving history, as a record of accidents or claims may lead to higher rates, and your credit score, which underwriting companies often consider when setting premiums.

Furthermore, insurance provider policies can vary widely, with some offering more comprehensive coverage options or discounts than others, depending on their assessment criteria. Location can also influence rates; urban areas with higher theft rates or accident statistics often lead to increased premiums. Additionally, the amount financed relative to the vehicle’s actual cash value will affect the gap insurance you may require. Understanding these factors can empower you to make informed decisions and potentially find better rates for your gap insurance.

Tips for Choosing the Right Gap Insurance for Your Vehicle

When selecting the right gap insurance for your vehicle, it’s essential to consider several factors that can significantly influence your policy’s effectiveness. Start by evaluating your current insurance coverage and the value of your vehicle. If your car is financed or leased, this gap insurance becomes even more crucial. Ensure you understand the terms of your existing policy, specifically regarding the payout limits in case of total loss or theft. This knowledge will help you determine how much additional coverage you need to bridge the gap between what you owe and the actual cash value of your vehicle.

Another important aspect is to compare different gap insurance providers. Look for providers that offer competitive rates and comprehensive coverage options. Consider the following criteria when evaluating your choices:

- Policy Coverage: Understand what is included and excluded in the coverage.

- Deductibles: Assess the deductible amounts, as a lower deductible could mean higher premiums.

- Claim Process: Research the provider’s reputation for customer service and ease of claims processing.

- Duration of Coverage: Check how long the gap insurance will remain effective, especially if your loan term extends beyond standard coverage periods.

| Provider | Premium Range | Key Benefits |

|---|---|---|

| Provider A | $200 – $300/year | Comprehensive coverage, no deductible |

| Provider B | $150 – $250/year | Quick claims process, flexible terms |

| Provider C | $180 – $290/year | Discounts for multi-policy holders |

Key Takeaways

understanding gap insurance is crucial for any vehicle owner looking to safeguard their investment. Whether you’re financing a new car or leasing, gap insurance provides an added layer of protection against the unexpected. By familiarizing yourself with how gap insurance works, the scenarios in which it’s applicable, and its potential costs, you can make an informed decision that aligns with your financial situation and peace of mind. If you’re considering gap insurance, take the time to compare different providers and policies to find the best fit for your needs. Remember, being well-informed is the first step towards smart financial choices for your vehicle. We hope this guide has shed some light on gap insurance and helped you navigate your options with confidence. Safe driving!