In today’s unpredictable world, financial security is more important than ever. As we navigate through various life stages—from starting a new job and buying a home to planning for retirement—effective financial planning becomes essential for building a solid foundation for our futures. One crucial element that often gets overlooked in this process is insurance. Whether it’s health, auto, home, or life insurance, understanding these policies and their benefits can significantly impact our financial well-being. In this article, we’ll explore the role of insurance in financial planning, demystifying its complexities and highlighting how the right coverage can safeguard your assets and provide peace of mind. Join us as we delve into why insurance is not just an expense, but a strategic investment in your financial future.

Table of Contents

- The Importance of Insurance in Financial Security

- Types of Insurance You Should Consider

- How to Evaluate Your Insurance Needs

- Tips for Choosing the Right Insurance Provider

- The Way Forward

The Importance of Insurance in Financial Security

In today’s unpredictable world, having a robust safety net is essential for safeguarding your financial well-being. Insurance serves this purpose by providing a safety blanket against life’s unforeseen events. It enables individuals and families to manage risk effectively, ensuring that unexpected medical expenses, damage to property, or loss of income do not derail their financial stability. By investing in various insurance policies, you not only protect your assets but also gain peace of mind, knowing that you’ve taken proactive steps toward financial resilience.

Moreover, insurance plays a pivotal role in comprehensive financial planning as it allows for better investment and savings strategies. With the assurance that certain risks are covered, individuals can confidently allocate funds toward long-term goals, such as retirement, education, or home ownership. Below are some key benefits that underscore the significance of coverage in financial security:

- Asset Protection: Safeguards home, car, and personal belongings.

- Health Security: Covers significant medical bills and promotes access to healthcare.

- Income Continuity: Ensures financial stability in case of job loss or disability.

- Estate Planning: Assists in wealth transfer without heavy taxation.

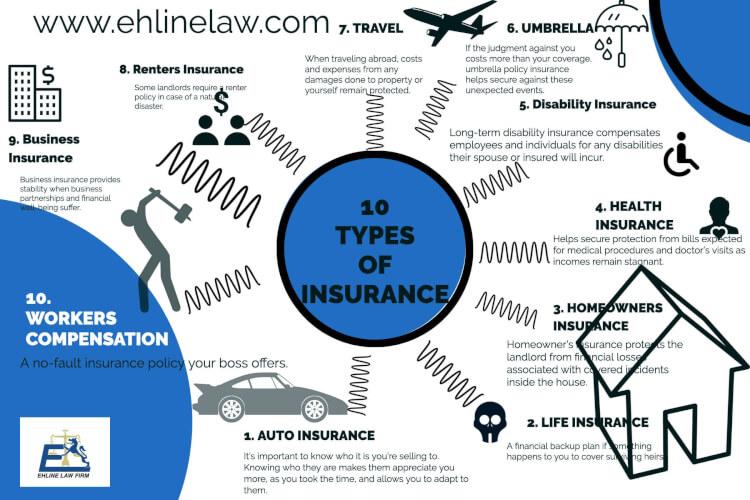

Types of Insurance You Should Consider

When it comes to safeguarding your financial future, selecting the right types of insurance is crucial. Here are some essential coverage options to consider:

- Health Insurance: This is fundamental in managing medical expenses and ensuring access to necessary healthcare services.

- Life Insurance: Providing financial support to your loved ones after your passing can bring peace of mind.

- Auto Insurance: Protects you against financial loss in the event of an accident, theft, or damage to your vehicle.

- Homeowners or Renters Insurance: Covers your belongings and provides liability protection in case of accidents in your dwelling.

- Disability Insurance: Offers income replacement if you become unable to work due to illness or injury.

To ensure you have a comprehensive safety net, it’s advisable to evaluate your personal circumstances and risks associated with each type of insurance. Creating a balanced plan that caters to both your immediate needs and long-term goals is vital. Below is a comparison table of various insurance types that highlights their primary features:

| Insurance Type | Primary Coverage | Key Considerations |

|---|---|---|

| Health Insurance | Medical expenses | Premiums, deductibles |

| Life Insurance | Income support | Term vs. whole life |

| Auto Insurance | Accident & theft protection | State requirements, deductibles |

| Homeowners Insurance | Property and liability | Coverage limits, deductibles |

| Disability Insurance | Income replacement | Short-term vs. long-term |

How to Evaluate Your Insurance Needs

Assessing your insurance requirements begins with a thorough evaluation of your current circumstances and future aspirations. Consider existing obligations such as mortgages, loans, and family needs. Think about potential risks you might face and how insurance can act as a safety net. Construct a detailed inventory of your assets, including property, vehicles, and personal possessions, to understand what coverage you might require. Documenting these aspects gives you a clearer idea of your financial exposure and helps create a tailored plan. It’s also wise to factor in lifestyle changes—such as marriage, children, or new employment—which could necessitate adjustments in your coverage.

When exploring various policy options, keep in mind the following key criteria for evaluation:

- Coverage Amount: Ensure that the policy limits reflect the full value of what you want to protect.

- Premium Costs: Balance affordable premiums with adequate coverage—avoid skimping too much on essentials.

- Policy Terms: Read and comprehend the fine print; some policies may have gaps in coverage that are not immediately apparent.

Additionally, consider enlisting the help of a financial advisor or insurance expert to guide you through the nuances of different policies, especially as your needs evolve over time. Investing time and effort into understanding your insurance options today can yield significant peace of mind and financial security in the long run.

Tips for Choosing the Right Insurance Provider

When it comes to selecting an insurance provider, doing your homework can make all the difference. Start by evaluating the insurer’s financial stability and reputation. You can consult resources like A.M. Best or Moody’s to check their ratings. Additionally, consider their claims process; a provider with a straightforward and efficient claims system will give you peace of mind when it’s time to file a claim. You may also want to look for customer reviews and testimonials to gauge the overall satisfaction of other policyholders.

Another crucial aspect to investigate is the range of coverage options available. Different providers specialize in various types of insurance, such as auto, home, health, or life insurance. Ensure that the provider offers the kind of insurance you need, along with add-on policies for greater flexibility. It can be beneficial to request quotes from multiple providers to compare not just prices but also the coverage they offer. Keep an eye out for hidden fees and exclusions in their policies by thoroughly reading the fine print.

The Way Forward

understanding insurance is an essential pillar of effective financial planning. By grasping the different types of insurance and their unique roles in protecting your assets and ensuring financial stability, you can make informed decisions that align with your long-term goals. Whether it’s life, health, auto, or home insurance, each type serves as a safety net, providing peace of mind and security in an unpredictable world. As you navigate your financial journey, consider taking the time to review your current coverage and assess any gaps that may exist. Remember, being proactive about your insurance needs not only safeguards your finances but also empowers you to focus on what truly matters in life. Thank you for joining us in this exploration of insurance, and we hope you feel more equipped to integrate this critical component into your financial planning strategy.