Navigating the world of insurance can often feel overwhelming, especially when it comes to understanding the various terms and conditions that accompany your policy. One of the most crucial concepts to grasp is the insurance deductible. Whether you’re purchasing health, auto, or homeowners insurance, deductibles play a significant role in determining your out-of-pocket expenses and the overall cost of your coverage. In this article, we’ll break down what deductibles are, how they function, and the factors to consider when selecting the right deductible for your needs. By the end, you’ll have a clearer understanding of this essential aspect of insurance, helping you make informed decisions as you navigate your coverage options.

Table of Contents

- Understanding the Basics of Insurance Deductibles and Their Importance

- Types of Insurance Deductibles: What You Need to Know

- Calculating Your Deductible: Tips for Selecting the Right Amount

- Maximizing Your Insurance: Strategies for Managing Deductibles Effectively

- Concluding Remarks

Understanding the Basics of Insurance Deductibles and Their Importance

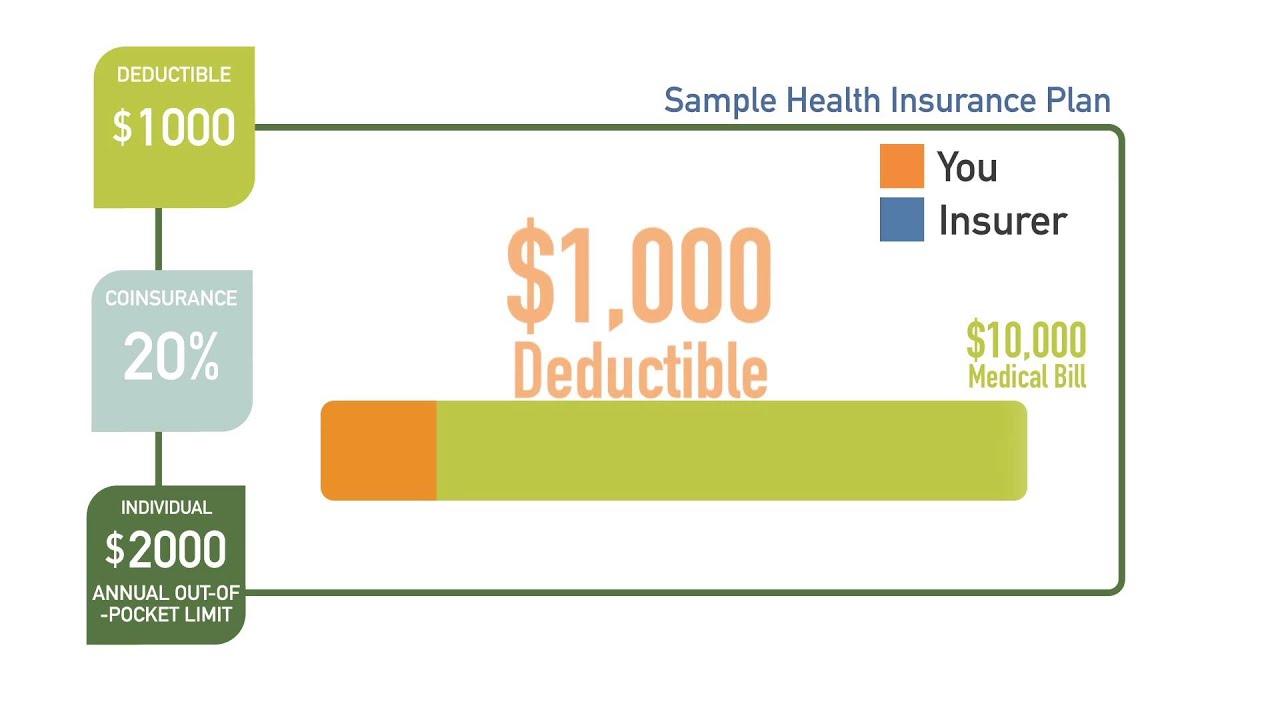

Insurance deductibles are a crucial element in understanding your insurance policy. They represent the amount you must pay out of pocket before your insurance coverage kicks in. Essentially, a deductible is your shared financial responsibility in the insurance process. In many cases, higher deductibles can lead to lower premium costs, making this a significant factor when evaluating insurance options. For instance, if your policy has a deductible of $500 and you file a claim for $2,000, you will be responsible for the first $500, while your insurer will cover the remaining $1,500. This shared risk mechanism helps insurance companies manage their overall costs and keeps premiums more affordable for everyone.

Understanding how deductibles work not only aids in making informed decisions but also helps with effective financial planning. The impact of a deductible can vary based on the type of insurance, for instance:

| Insurance Type | Common Deductible Range | Impact on Premiums |

|---|---|---|

| Health Insurance | $0 – $10,000+ | Higher deductible = Lower premium |

| Auto Insurance | $250 – $1,000 | Higher deductible = Lower premium |

| Homeowners Insurance | $500 – $2,500 | Higher deductible = Lower premium |

This table illustrates that the structure of deductibles is designed to align your financial input with the type of coverage you require. By choosing the right deductible for your circumstances, you can better balance your premium costs and financial exposure. Always consider your budget and risk preferences when selecting a deductible to ensure the best possible outcome in times of need.

Types of Insurance Deductibles: What You Need to Know

Understanding the different types of insurance deductibles is crucial for managing your policy effectively. Generally, deductibles can be classified into a few main categories. Common types include:

- Fixed Deductibles: A specific dollar amount that must be paid before insurance kicks in, usually seen in health and auto insurance.

- Percentage Deductibles: Calculated as a percentage of the claim amount, typically used in property insurance, such as homeowners insurance.

- Aggregate Deductibles: The total amount that must be paid for all claims over a specific period, often applied in health care plans.

Each type of deductible serves a distinct purpose, impacting your premium rates and out-of-pocket costs. Consider these key aspects:

| Type of Deductible | Typical Usage | Impact on Premiums |

|---|---|---|

| Fixed Deductible | Health, Auto | Lower premiums with higher deductibles |

| Percentage Deductible | Property | Can lead to high out-of-pocket costs in disasters |

| Aggregate Deductible | Health Plans | Stabilizes costs over time but can be costly up front |

Calculating Your Deductible: Tips for Selecting the Right Amount

Choosing the right deductible amount can significantly impact your finances, both in terms of monthly premiums and out-of-pocket expenses when a claim arises. Here are some essential tips to guide you in making an informed decision:

- Evaluate your financial situation: Consider how much you can comfortably afford to pay out-of-pocket in case of an emergency.

- Analyze your insurance needs: Look at your coverage requirements and determine how often you might use your insurance. If you rarely file claims, a higher deductible might be beneficial.

- Review your insurance policy: Always read through the terms of your policy to understand how various deductible amounts affect your premiums and claims.

To further illustrate how deductible amounts can influence your costs, examine the following table showcasing potential scenarios:

| Deductible Amount | Monthly Premium | Out-of-Pocket for a Claim ($5,000) |

|---|---|---|

| $500 | $150 | $5,500 |

| $1,000 | $125 | $6,000 |

| $2,500 | $100 | $7,500 |

This table outlines how varying deductible levels can impact both your premiums and out-of-pocket expenses. By analyzing this data, you can better assess which deductible aligns with your budget and risk tolerance.

Maximizing Your Insurance: Strategies for Managing Deductibles Effectively

Effectively managing your insurance deductibles can significantly enhance your financial security in the long run. Understanding the specifics of your plan is crucial; familiarize yourself with the various deductible tiers available. Here are some strategies to consider:

- Choose a higher deductible: If you’re in a position to cover higher out-of-pocket expenses, opting for a higher deductible can lower your monthly premiums.

- Emergency fund: Establish an emergency fund specifically to cover potential deductible payments should an unexpected event arise.

- Regular assessments: Review your policies regularly to ensure your coverage aligns with your changing needs and consider shopping around for better terms.

Furthermore, understanding how to utilize your insurance plan’s options can offer added benefits. For instance, some policies may provide incentives for preventive care, which can reduce overall costs and even your deductible over time. Consider tracking your claims and expenses diligently – this will not only help you spot patterns but may also reveal opportunities to alter your deductible amount or switch to a plan that better fits your lifestyle. Below is a simple comparison table showcasing potential deductible amounts and their corresponding premium savings:

| Deductible Amount | Monthly Premium | Annual Savings |

|---|---|---|

| $500 | $150 | $0 |

| $1,000 | $120 | $360 |

| $2,000 | $100 | $600 |

Concluding Remarks

understanding insurance deductibles is crucial for making informed decisions about your coverage. Whether you’re navigating health, auto, or home insurance policies, knowing how deductibles work can help you manage costs and anticipate expenses. By weighing the pros and cons of higher versus lower deductibles, you can choose a plan that aligns with your financial situation and risk tolerance. Remember, the key is to stay proactive—review your policies regularly and don’t hesitate to consult with your insurance agent to clarify any doubts. Equipped with this knowledge, you can approach your insurance choices with confidence and clarity, ensuring that you’re well-prepared for whatever life may throw your way.