When it comes to securing insurance coverage, whether for your home, vehicle, or health, one of the most pressing concerns is often the cost associated with premiums. Insurance premiums can vary widely from one individual or entity to another, leaving many to wonder what factors truly influence these rates. In this article, we will dive into the key elements that determine insurance premiums, helping you understand the intricate balance between risk assessment and pricing. From personal demographics to policy types and beyond, we’ll explore how various components play a role in shaping the cost of your insurance, ultimately equipping you with the knowledge to make informed decisions for your coverage needs. Whether you’re a first-time buyer or looking to reassess your current policies, a deeper understanding of these factors can empower you to navigate the insurance landscape with confidence.

Table of Contents

- Understanding Risk Assessment in Insurance Pricing

- The Role of Personal Factors in Determining Premiums

- Navigating Market Trends and Their Impact on Rates

- Effective Strategies to Lower Your Insurance Premiums

- In Conclusion

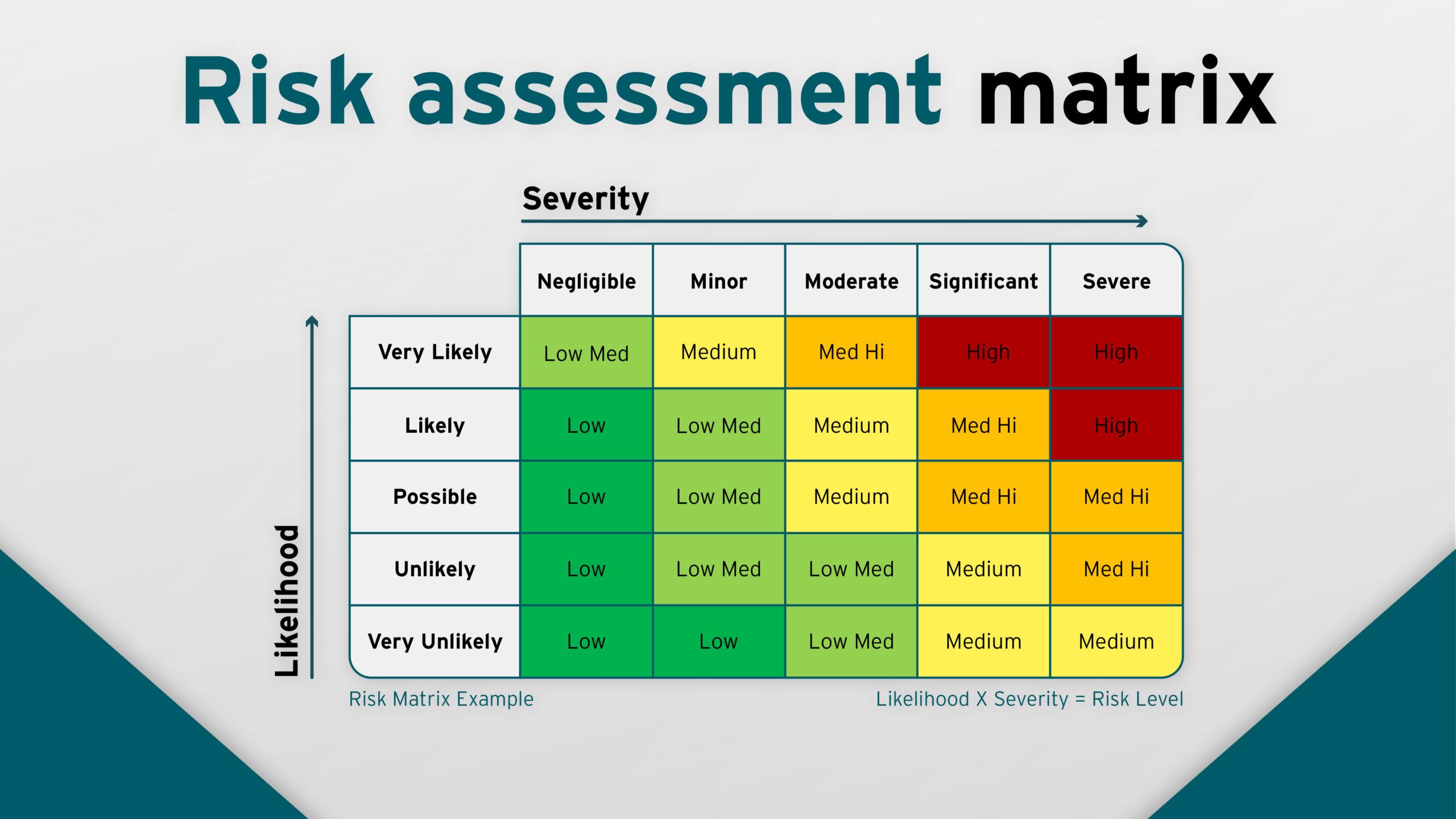

Understanding Risk Assessment in Insurance Pricing

Risk assessment is a critical process that insurance companies use to determine the likelihood of a claim being made, which directly influences the pricing of premiums. By evaluating various factors related to the policyholder, insurers can categorize risks appropriately. Some of the primary elements considered include:

- Demographics: Age, gender, and marital status can impact risk assessments. For instance, younger drivers often face higher premiums due to a perceived lack of experience.

- Health history: Individuals with chronic conditions may be considered higher risk in health insurance scenarios.

- Property characteristics: For homeowners insurance, factors such as location, property age, and security features are assessed.

- Claims history: A history of frequent claims can lead to higher premiums, as it suggests a pattern of risk.

Insurance pricing models rely on statistical data and predictive analytics to project future losses. Insurers often utilize sophisticated algorithms to interpret vast amounts of data from various sources. Below is a simplified overview of how different factors influence risk assessment:

| Factor | Impact on Risk Assessment |

|---|---|

| Driving Record | Negative history increases premium rates. |

| Credit Score | Lower scores may lead to higher premiums. |

| Property Location | High-crime or flood-prone areas lead to increased costs. |

The Role of Personal Factors in Determining Premiums

When it comes to determining insurance premiums, personal factors play a significant role in shaping the cost of coverage. Insurers assess individual circumstances to predict the likelihood of a claim, and they take various elements into account, such as:

- Age: Younger individuals may pay higher premiums due to inexperience, while older adults might benefit from lower rates.

- Gender: Statistical data often indicates differences in risk between genders, impacting premium calculations.

- Location: Areas with higher crime rates or natural disaster risks tend to have higher premiums.

- Credit History: A good credit rating is often correlated with responsible behavior, thus reducing premium costs.

- Driving Record: For auto insurance, a clean driving record leads to lower rates, while accidents can drastically increase costs.

Additionally, lifestyle choices and personal habits also contribute to premium determinations. Factors like smoking status, occupation, and even hobbies can influence the perceived risk associated with an insured individual. For instance, an individual engaged in high-risk activities such as skydiving or rock climbing may face elevated premiums due to the increased likelihood of accidents. Here’s a simple table showcasing how various personal factors can affect premium rates:

| Personal Factor | Impact on Premium |

|---|---|

| Age | Higher for younger drivers |

| Gender | Potentially different rates |

| Location | Varies by crime and disaster risks |

| Credit History | Better credit lowers rates |

| Driving Record | Clean record reduces premiums |

Navigating Market Trends and Their Impact on Rates

In the ever-evolving landscape of insurance, market trends play a pivotal role in shaping premiums. Factors such as economic conditions, risk assessment practices, and competitive positioning are crucial for insurers and policyholders alike. When the economy experiences fluctuations, insurers may adjust their pricing strategies to align with the anticipated claims likelihood. Additionally, the rise of advanced data analytics has transformed risk assessment, allowing insurers to fine-tune their premium calculations based on real-time information. This can lead to disparities in rates among different providers, often leaving consumers with a wider range of options but also added complexity in choosing the best coverage.

Moreover, it’s essential to recognize how emerging trends like climate change and technological advancements are influencing rates in various sectors. For instance, natural disasters have prompted insurers to reassess risk models and, in many cases, increase premiums for property insurance in high-risk areas. At the same time, the integration of technology has introduced new factors, such as the emergence of autonomous vehicles impacting auto insurance rates. Understanding these interconnected trends can empower consumers to navigate the market more effectively and make informed decisions regarding their insurance needs.

| Trend | Impact on Premiums |

|---|---|

| Economic Fluctuations | Adjustments in pricing strategy |

| Data Analytics | More tailored premium calculations |

| Climate Change | Increased rates in high-risk areas |

| Technological Advancements | Shifts in auto insurance pricing |

Effective Strategies to Lower Your Insurance Premiums

Lowering your insurance premiums can often feel like a daunting task, but several effective strategies can help you achieve significant savings. Begin by shopping around for quotes; different insurers assess risk and set premiums in various ways. Utilize online comparison tools to find the best rates tailored to your profile. Additionally, consider bundling multiple policies, like home and auto insurance, with the same provider, as many companies offer substantial discounts for bundled services.

Another way to reduce premiums is to increase your deductible. A higher deductible can lead to lower monthly payments; just ensure that you can comfortably pay the deductible in case of a claim. Additionally, taking advantage of available discounts is essential. Many insurers provide reductions for things such as maintaining a safe driving record, being a member of certain organizations, or installing security features in your home. Below is a simple table illustrating common discounts offered by insurers:

| Discount Type | Description |

|---|---|

| Multi-Policy | Discounts for bundling home and auto insurance |

| Safe Driving | Rewards policyholders with a clean driving record |

| Home Security | Discounts for security systems or alarms in your home |

| Good Student | For students maintaining a high GPA |

In Conclusion

understanding the key factors that influence insurance premiums is essential for making informed decisions about your coverage. From personal demographics to the types of coverage you choose, many elements come into play when insurers determine your premium rates. By familiarizing yourself with these factors, you can not only better anticipate your insurance costs but also take proactive steps to manage them. Whether you’re shopping for a new policy or reviewing your existing coverage, knowledge is your best tool. Remember, insurance is not just a necessary expense—it’s a way to protect your assets and plan for the future. Stay informed, compare your options, and don’t hesitate to seek advice if you need it. Thank you for reading, and we hope this article has provided valuable insights into the world of insurance premiums!