When it comes to healthcare, one of the most important decisions you’ll face is whether to opt for public or private insurance. This choice can significantly impact your access to services, the quality of care, and your overall healthcare experience. With a myriad of plans, coverage options, and costs to consider, navigating the insurance landscape can feel overwhelming. In this article, we’ll break down the key differences between public and private insurance, examining the benefits and drawbacks of each to help you make an informed decision. Whether you’re a first-time insurance buyer, a seasoned pro looking to switch plans, or simply curious about your options, understanding the nuances of these two systems is essential for finding the right fit for your healthcare needs. Join us as we explore the factors to consider in the public versus private insurance debate and provide insights to guide you on your journey toward better health coverage.

Table of Contents

- Understanding the Key Differences Between Public and Private Insurance

- Evaluating Your Healthcare Needs and Financial Situation

- The Pros and Cons of Public Insurance Options

- Making an Informed Decision: Tips for Choosing the Right Insurance Plan

- In Retrospect

Understanding the Key Differences Between Public and Private Insurance

The choice between public and private insurance can significantly impact your healthcare experience. Public insurance, often funded by the government, tends to have lower premiums and wider accessibility. It is designed to provide essential health services to all citizens, ensuring that financial barriers do not prevent individuals from receiving care. However, there may be longer wait times for services, and the choice of providers can be limited. Key features of public insurance include:

- Lower Costs: Generally, premiums and out-of-pocket costs are more affordable.

- Comprehensive Coverage: Basic healthcare services are often covered, including hospital visits and preventive care.

- Government Oversight: Standards for care and regulations are enforced to ensure quality and equity.

On the other hand, private insurance offers flexibility and a broader range of services, often with quicker access to specialists. This type of insurance may come with higher premiums, but it usually provides more personalized care options and the ability to choose one’s healthcare providers. Here are some notable aspects of private insurance:

- Customization: Plans can be tailored to fit individual needs, allowing for specific coverage options.

- Quicker Access: Patients often face shorter wait times for services and appointments.

- Broader Network: More healthcare providers and specialists are typically available.

Evaluating Your Healthcare Needs and Financial Situation

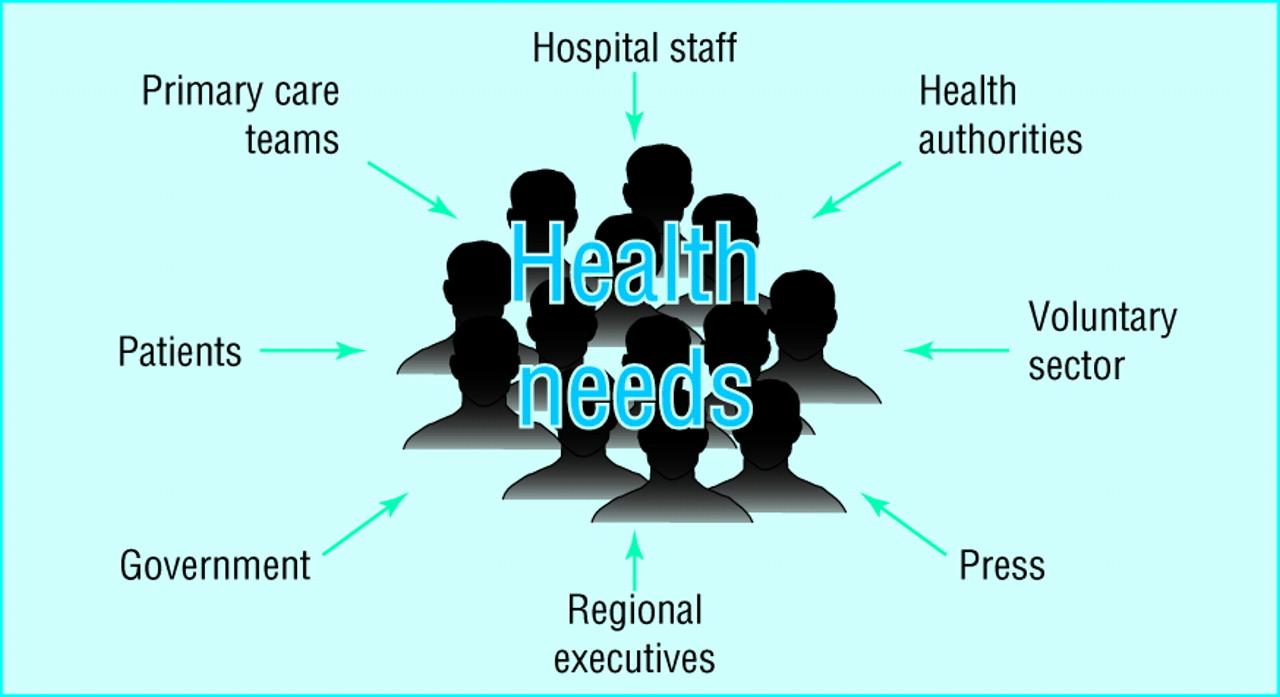

When determining the best insurance option for your personal circumstances, it’s crucial to assess both your healthcare needs and your financial situation. Start by listing the medical services you frequently use, such as primary care visits, specialist consultations, or prescription medications. Additionally, consider any ongoing health issues that may require regular treatment or interventions. This can help you identify the level of coverage you require. Simultaneously, evaluate your budget. What’s the maximum amount you’re willing to pay for premiums, deductibles, and out-of-pocket expenses? Understanding your financial readiness will guide you in choosing an insurance plan that aligns with your needs without causing stress on your finances.

Moreover, identifying the type of insurance that fits your lifestyle is essential. Public insurance often offers lower premiums but might come with limited options for providers and longer waiting times for non-emergency procedures. In contrast, private insurance tends to provide more flexibility and shorter wait times, yet it can be significantly more expensive. To help visualize your options, consider the following factors:

- Rate of Premiums: Public plans generally have lower premiums.

- Provider Network: Private plans may grant access to a wider range of healthcare providers.

- Out-of-Pocket Costs: Public insurance can have higher deductibles and co-pays.

- Coverage Options: Private insurance often includes add-ons like dental and vision care.

The Pros and Cons of Public Insurance Options

The debate surrounding public insurance options often revolves around their accessibility and affordability. One of the primary advantages is that they can provide health coverage to individuals who might otherwise be uninsured, particularly low-income families. Furthermore, public options typically offer lower premiums and have reduced administrative costs. Here are some key benefits:

- Universal Coverage: Aims to cover everyone, reducing the number of uninsured individuals.

- Negotiated Prices: Often able to negotiate lower drug prices and medical fees.

- Simplicity: Easier enrollment processes and benefits make it more accessible for users.

However, public insurance options are not without their drawbacks. Critics often point out the potential for longer wait times for medical procedures and limited choices when it comes to healthcare providers. There can also be concerns about the overall quality of care, as government regulations may lead to less personalized service. Consider these possible disadvantages:

- Wait Times: Patients might experience longer periods to receive necessary care.

- Provider Limitations: Fewer choices in doctors or specialists compared to private insurance.

- Funding Issues: Rely on taxpayer funding, which may be subject to budget cuts.

Making an Informed Decision: Tips for Choosing the Right Insurance Plan

When it comes to selecting an insurance plan, the process can seem daunting due to the vast variety of options available. To make an informed choice, it’s essential to evaluate your personal health needs and financial situation critically. Start by defining your priorities, whether that includes cost, coverage options, or network availability. Gather information on the unique features of public and private insurance plans, and consider the following points:

- Coverage Scope: Assess the range of services provided, including preventative care, specialist visits, and hospital stays.

- Premiums and Out-of-Pocket Costs: Calculate your monthly premiums and potential deductibles to find what fits within your budget.

- Accessibility: Research the ease of accessing healthcare providers and facilities.

Another key factor is your eligibility for each type of insurance, especially in public options that may have specific criteria. It’s worthwhile to compare the pros and cons of each type side by side. Consider creating a simple comparison table to encapsulate your findings:

| Aspect | Public Insurance | Private Insurance |

|---|---|---|

| Cost | Generally lower premiums, may have limited options | Higher premiums, but more comprehensive options |

| Flexibility | Fewer choices for providers | Wider selection of healthcare professionals |

| Eligibility | Based on income and family size | Open to all, varies by plan |

In Retrospect

navigating the complex landscape of public versus private insurance can be a daunting task, but with the right information and understanding of your personal needs, you can make a choice that best fits your circumstances. Whether you prioritize affordability, flexibility, or breadth of coverage, each option has its unique advantages and potential drawbacks.

It’s important to assess not only your current health situation but also your future needs, budget, and lifestyle. Remember that your insurance choice is not set in stone; it can evolve as your life circumstances change. So take the time to research, ask questions, and even consult with professionals if necessary.

Ultimately, the goal is to ensure that you and your family are protected and that accessing healthcare is smooth and stress-free. Whatever path you choose, being informed is the first step toward making a decision you can feel confident about. Thank you for reading, and we hope this article has empowered you to make the best choice regarding your health insurance.