When it comes to owning a vehicle, car insurance is an essential, albeit often misunderstood, aspect of responsible car ownership. Navigating the world of car insurance can feel overwhelming, with a myriad of options, terms, and coverage types to consider. From liability coverage to collision and comprehensive policies, each component plays a critical role in protecting you, your vehicle, and your finances on the road. In this comprehensive guide, we will break down the basics of car insurance, demystifying the jargon and helping you make informed decisions. Whether you’re a first-time buyer or looking to refresh your knowledge, understanding these fundamentals will empower you to choose the car insurance policy that best fits your needs and budget. Let’s steer into the essentials and unravel the complexities of car insurance together.

Table of Contents

- Key Types of Car Insurance Coverage Explained

- Factors Influencing Your Car Insurance Premium

- Tips for Comparing Car Insurance Policies Effectively

- Common Myths About Car Insurance Debunked

- The Way Forward

Key Types of Car Insurance Coverage Explained

When navigating the world of car insurance, understanding the various types of coverage is essential. Each specific type of insurance serves a unique purpose and can significantly impact your driving experience and financial safety. Here are some of the primary types of coverage you should be familiar with:

- Liability Coverage: This is often mandated by law and it covers damages to other people and their property if you’re at fault in an accident.

- Collision Coverage: This type helps pay for repairs to your own vehicle after a collision, regardless of who is at fault.

- Comprehensive Coverage: Offering protection from non-collision-related incidents, such as theft, vandalism, or natural disasters, this coverage is ideal for safeguarding your vehicle against unforeseen events.

- Uninsured/Underinsured Motorist Coverage: This is crucial if you’re involved in an accident with a driver who has no insurance or insufficient coverage.

Understanding the distinctions between these coverage types can help you select a policy that best suits your needs. To summarize, here’s a quick comparison table that highlights the key points:

| Coverage Type | What It Covers | Is It Mandatory? |

|---|---|---|

| Liability | Injury and damage to others | Yes |

| Collision | Repairs to your vehicle | No |

| Comprehensive | Theft, vandalism, natural disasters | No |

| Uninsured/Underinsured | Accidents with uninsured drivers | No, but recommended |

Factors Influencing Your Car Insurance Premium

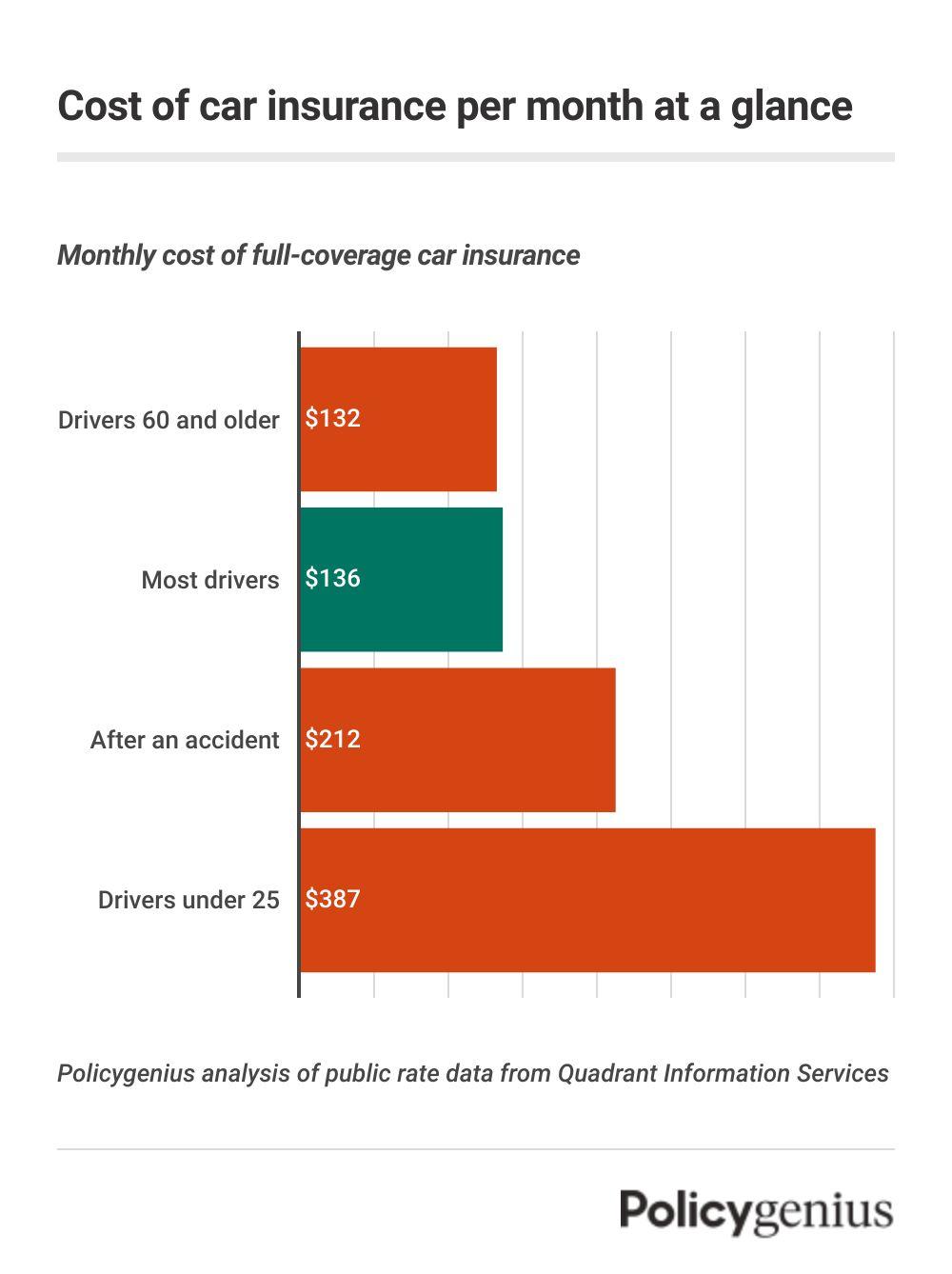

When determining your car insurance premium, several factors come into play, each influencing the cost you’ll ultimately pay. Your driving history is paramount; a clean record can lead to lower rates, while accidents or traffic violations may drive costs up. The type of vehicle you drive also significantly impacts your premium. Vehicles that are more prone to theft or those with lower safety ratings typically attract higher premiums. Furthermore, the region where you live plays a role, as areas with higher crime rates or accident statistics usually see higher insurance costs.

Additionally, your age and gender impact your insurance rates, with younger drivers often facing higher premiums due to inexperience. Credit history is another important consideration; many insurers examine credit scores, with lower scores generally leading to increased premiums. Lastly, the amount of coverage and deductibles you choose will affect your premium amount—opting for higher coverage often means a higher cost, while selecting a higher deductible may lower your premium. Understanding these factors can help you make informed decisions when shopping for car insurance.

Tips for Comparing Car Insurance Policies Effectively

When it comes to selecting a car insurance policy, the process can be overwhelming due to numerous options and variables. To ensure you choose the best coverage for your needs, start by assessing your requirements thoroughly. Consider factors such as your driving habits, the type of vehicle you own, and your financial situation. Make a list of key features that matter most to you, such as:

- Liability Coverage: Protection against claims brought by others due to accidents.

- Comprehensive Coverage: Covers non-collision incidents, like theft or natural disasters.

- Collision Coverage: Helps pay for damages to your car in case of an accident.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re hit by an uninsured driver.

Next, take the time to compare quotes from various providers. Use online tools to obtain estimates based on the same coverage levels for a fair comparison. It’s also beneficial to examine the insurer’s reputation by reading customer reviews and checking ratings from trusted ratings agencies. Create a simple table to summarize your findings, which can help visualize the options available:

| Insurance Provider | Annual Premium | Comprehensive | Collision | Customer Rating |

|---|---|---|---|---|

| Provider A | $800 | Yes | Yes | 4.5/5 |

| Provider B | $750 | No | Yes | 4.0/5 |

| Provider C | $900 | Yes | No | 4.8/5 |

Common Myths About Car Insurance Debunked

There are several widespread misconceptions about car insurance that can lead to confusion and potentially costly mistakes. One common myth is that all driving records are treated equally when determining insurance rates. In reality, insurance companies assess a variety of factors including the frequency of claims, type of violations, and even the amount of time since a violation occurred. If you’ve had minor infractions in the past, but have maintained a clean record for several years, you may benefit from lower premiums. It’s essential to understand that the context of your driving history is what truly matters.

Another prevalent myth suggests that car insurance follows the driver, not the vehicle, meaning that a person can drive any car without needing additional coverage. While it’s true that some policies may provide limited coverage for occasional drivers, this is not universal. Many insurers focus on the primary driver of the vehicle; in situations involving an accident, failure to be insured on the car being driven can lead to significant out-of-pocket expenses. Always verify your covering details to avoid unexpected liabilities that could ensue from this misunderstanding.

The Way Forward

navigating the world of car insurance can initially seem daunting, but understanding the basics can empower you to make informed decisions. By familiarizing yourself with key concepts such as coverage types, premium factors, and claims processes, you can tailor a policy that meets your needs and protects you on the road. Remember, it’s essential to shop around, compare quotes, and ask questions to ensure you find the best coverage at a fair price. Armed with this knowledge, you’re now better equipped to tackle your car insurance decisions with confidence. Whether you’re a first-time buyer or looking to reassess your current policy, taking the time to understand these fundamentals can lead to significant savings and peace of mind. Safe driving!